- Fecha(s): 19/04/2018

- Lugar: Seminario del Departamento de Métodos Cuantitativos para la Economía y Empresa, UMU. Retransmisión en directo.

- Ponente: Xesús Pereira López. Universidad de Santiago de Compostela

En el ámbito de la generación de tablas input-output regionales, se ha visto como la formulación de los cocientes de localización –desde las propuestas incipientes hasta la fórmula aumentada de Flegg– ha sufrido cambios. Ahora bien, las distintas modificaciones presentan cierta sencillez; en donde las tasas de variación del empleo o producción, así como el…

- Fecha(s): 29/09/2017

- Lugar: Seminario del Departamento de Métodos Cuantitativos para la Economía y Empresa, UMU. Retransmisión en directo.

- Ponente: Mª de Mar Sánchez de la Vega. Universidad de Murcia

The aim of this work is to propose a statistical methodology in order to estimate the macromagnitud Gross Value Added per capita (GVApc) in the local geographical area. The procedure proposed consists of estimating a panel model which includes Griffith’s spatial filtering (1996, 2000) to capture the spatial dependence in the whole analyzed period. The…

- Fecha(s): 11/07/2017

- Lugar: Sala de Seminarios (Edificio Torretamarit), Universidad Miguel Hernández (Campus de Elche) . Se grabará.

- Ponente: Magdalena Kapelko, Wroclaw University of Economics, Institute of Applied Mathematics, Department of Logistics

Abstract This paper extends the measurement of dynamic productivity change over time to provide its full decomposition into economically meaningful components in the Data Envelopment Analysis framework. The dynamic approach accounts for dynamics of production decisions via adjustment costs and is visualized as a dynamic Luenberger productivity change indicator. The paper also estimates the dynamic…

- Fecha(s): 16/06/2017

- Lugar: Sala de Seminarios (Edificio Torretamarit) UMH (Se grabará)

- Ponente: Priscila Lopes, Universidade Federal do Rio Grande do Norte, Natal (Brazil)

- Porconfirmar: 1

Brazil is proportionally a relatively unimportant player in the world fisheries scenario. However, small-scale fisheries (SSF) specifically are crucial for local livelihoods and the food security of millions of people, both on the coast and inland. Such fisheries provide more than 50% of the total Brazilian catches, suggesting that they can be highly impacting on…

- Fecha(s): 26/01/2017

- Lugar: Seminario del Departamento de Métodos Cuantitativos para la Economía y Empresa, UMU. Retransmisión en directo.

- Ponente: José J. García Clavel, Universidad de Murcia

Abstract: Due to the presence of duality, cluster analysis has been proposed to analyze Total Information Analysis super distance matrix instead of a row-column joint graph. But the same duality causes that the traditional methods of clustering are not always capable to produce meaningful results. In this paper following Nishisato (2014), the clustering with p-percentile…

- Fecha(s): 05/05/2016

- Lugar: Seminario del Departamento de Métodos Cuantitativos para la Economía y Empresa, UMU. Retransmisión en directo .

- Ponente: Mohammed Dore. Brock University.

We consider quarterly data of the Spanish economy from 1987 to 2013 to establish causal interconnections in a model free manner, using symbolic dynamics and permutation entropy (PE) and establish the exogeneity of adoption of the Euro (in Jan 1999) as the governing mechanism that leads to the key causal impacts on (1) interest rates,…

- Fecha(s): 27/11/2015

- Lugar: Seminario del Departamento de Métodos Cuantitativos para la Economía y Empresa, UMU. Retransmisión en directo.

- Ponente: Mª del Mar Sánchez de la Vega, Universidad de Murcia

Abstract This paper analyzes the rejection of tax fraud in Spain before and after the Great Depression and studies the role of certain determinants of two categories: internal or individual, and contextual, social or institutional. We use a logit model obtaining that the rejection of tax evasion depends positively on individual variables such as age…

- Fecha(s): 13/11/2015

- Lugar: Seminario del Departamento de Métodos Cuantitativos para la Economía y Empresa, UMU. Retransmisión en directo.

- Ponente: Mª Victoria Caballero Pintado, Universidad de Murcia

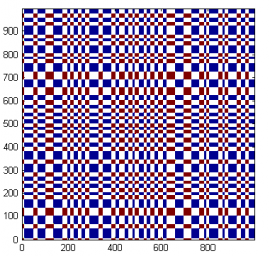

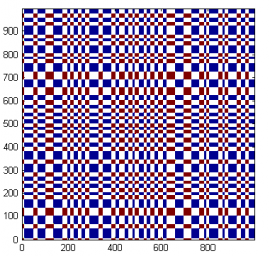

Abstract Análogamente a como los gráficos de recurrencia permiten visualizar la correlación integral de una serie temporal, definimos la herramienta gráfica para la correlación integral simbólica de una serie vectorial, son los gráficos de recurrencia simbólicos y gráficos de recurrencia simbólicos coloreados.Estos gráficos informan sobre la estructura de la serie como se ilustrara con distintos…

- Fecha(s): 30/10/2015

- Lugar: Seminario del Departamento de Métodos Cuantitativos para la Economía y Empresa, UMU. Se retransmitirá en directo.

- Ponente: María Isabel González-Martínez, Universidad de Murcia

Abstract Following the ideas of the Tourism Area Life Cycle (TALC) theory, we propose a dynamic econometric model for tourism demand where the reputation effect (the effect of the lagged demand on the current tourism demand) is not constant, but dependent on congestion. We test the model using panel data from Spanish regions during the…

- Fecha(s): 17/03/2015

- Lugar: Seminario del Departamento de Métodos Cuantitativos para la Economía y Empresa, UMU. Se retransmitirá en directo.

- Ponente: José Sánchez-Campillo, Universidad de Granada

Abstract Over ninety percent of the students taking the Spanish university admissions test (PAU) in recent years have passed on their first try. However, many public university degree programmes require high grades of their applicants. This requirement was reinforced in 2010 with the approval of the new PAU, which introduced a set of voluntary tests,…